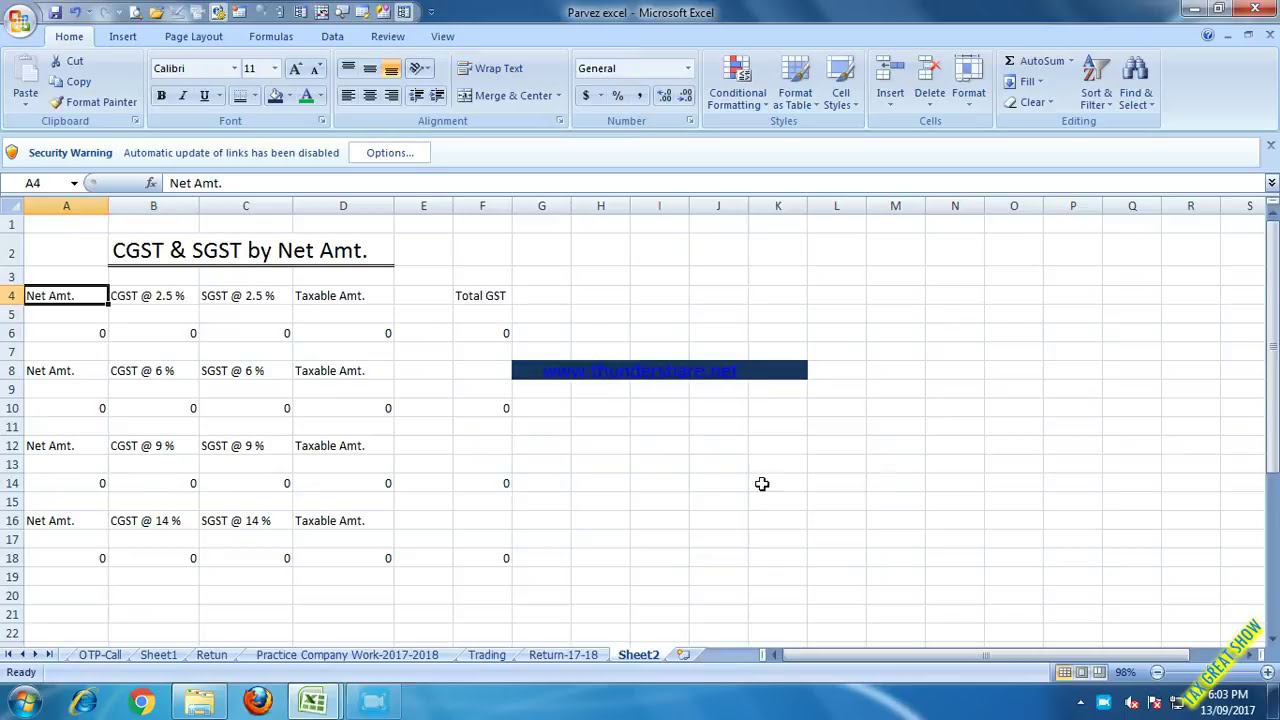

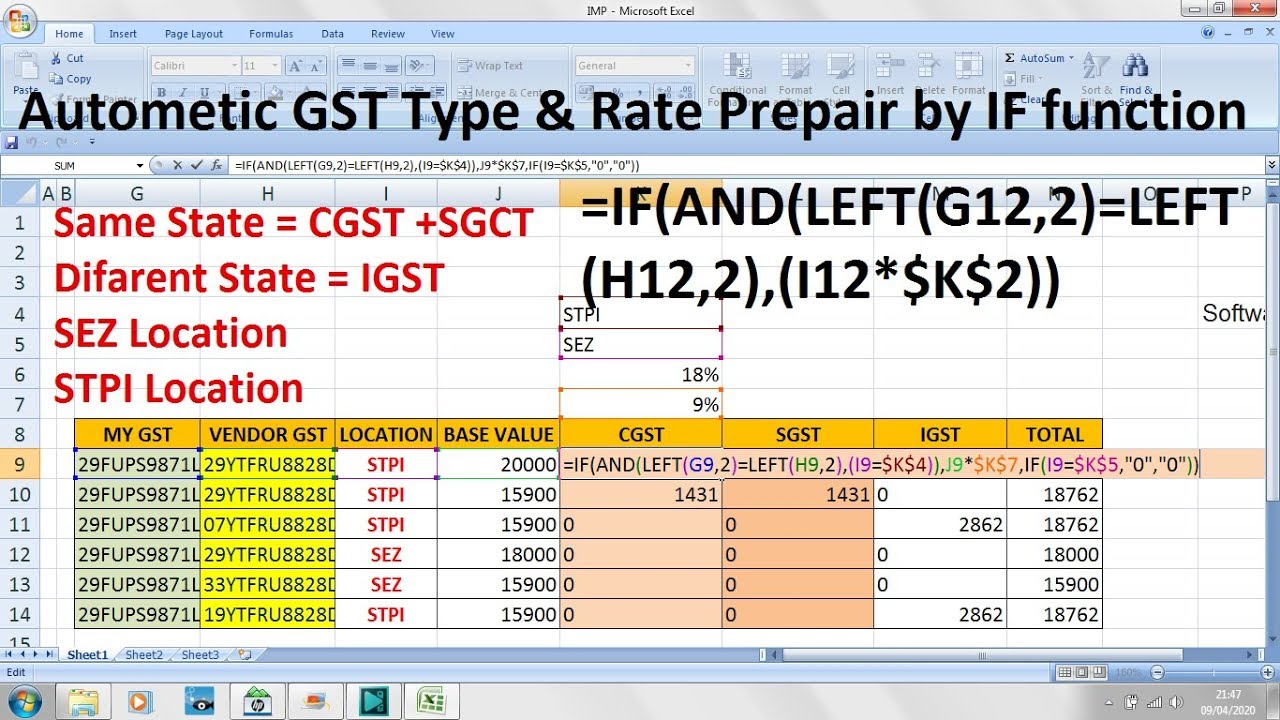

GST Calculation of CGST SGST by Excel Formula YouTube

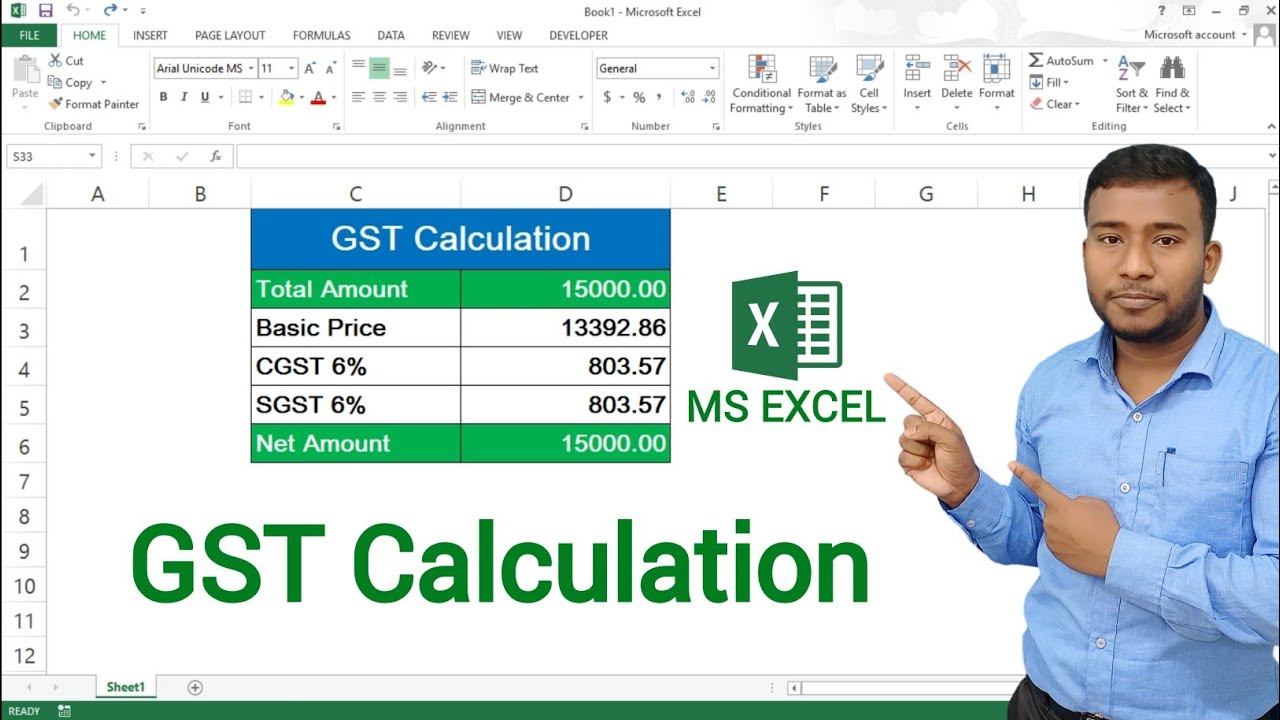

How To Calculate GST In Excel GST stands for Goods and Services Tax. Calculating GST is going to be made easy, with these simple steps. We are going to calculate it together. You should first layout the price before the GST. Click on the column beside GST amount, and decide how many percentage you would like the GST to be.

Gst Entry In Excel Excel में Gst Entry कैसे करते है Gst Formula In Ms Excel YouTube

Posted July 1, 2017 Post updated 18 October 2019 by Sharyn Baines A common request I receive is to please explain how to calculate GST at 15% using Excel formulas. You can find information on GST (Goods and Services Tax) on the NZ Inland Revenue website.

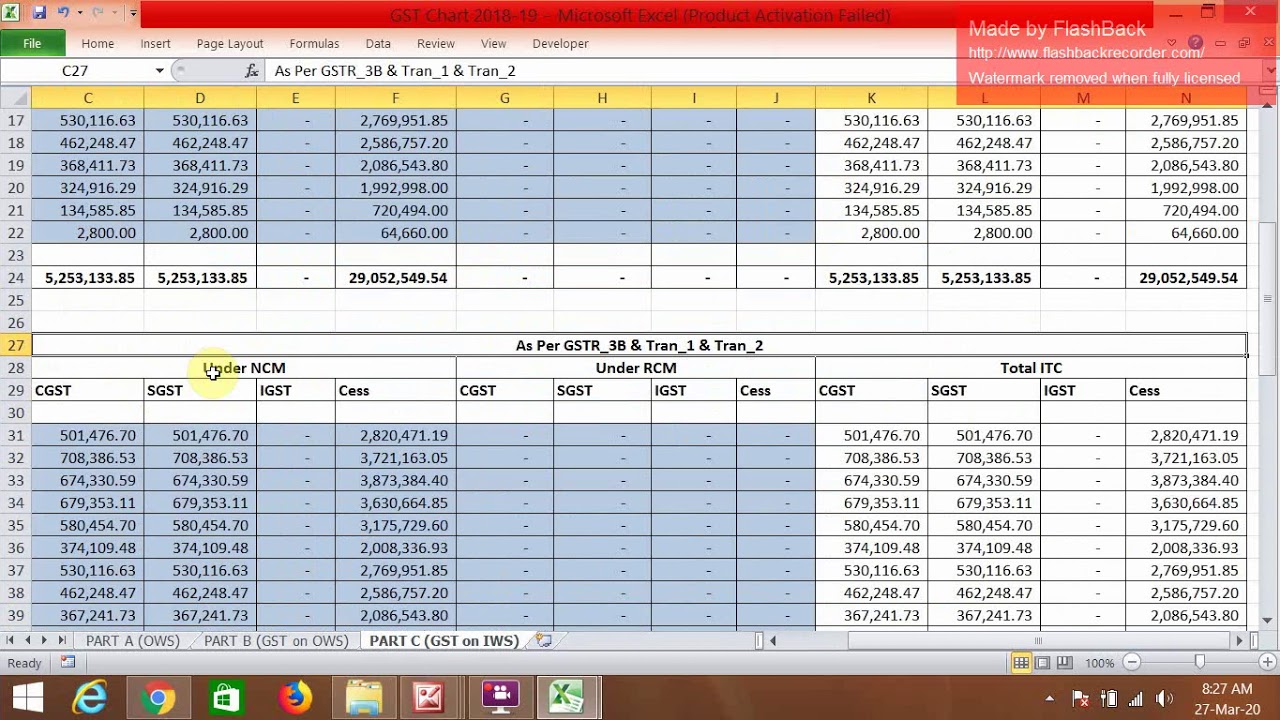

GST Excel Worksheet, GST Excel Sheet, GST Excel Chart, Reconciliation of Books with GST Returns

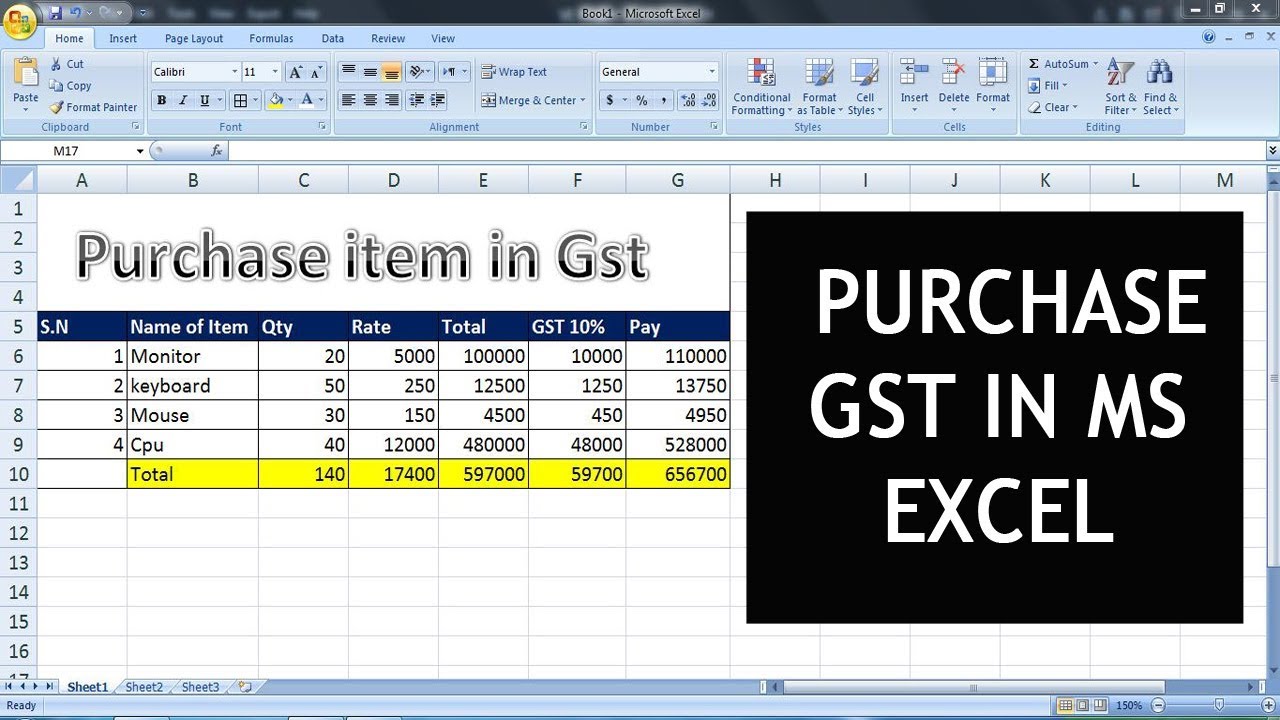

To begin, open Excel and create an appropriate table that will display the product's base price followed by the GST. Multiplying the goods' value by the applicable GST percentage would be the simplest way to calculate GST in Excel in this scenario. Apply the following formula to the contents of cell B4: = B2 * B3.

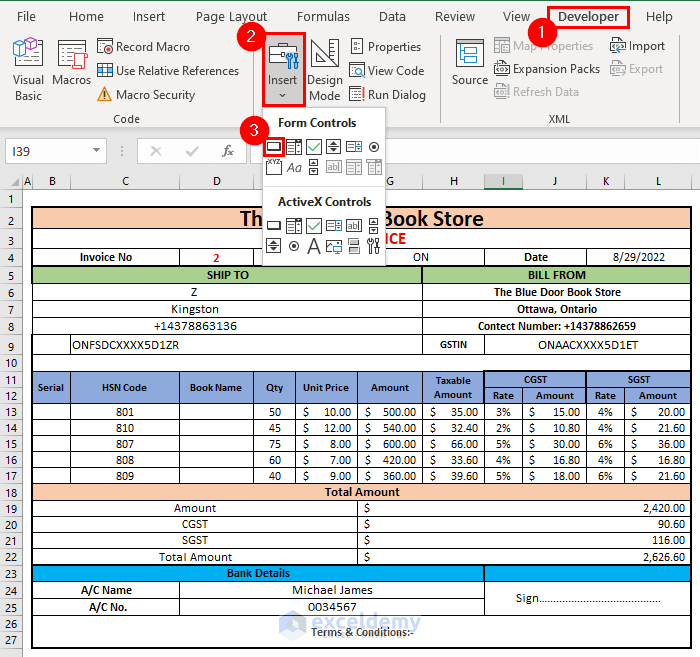

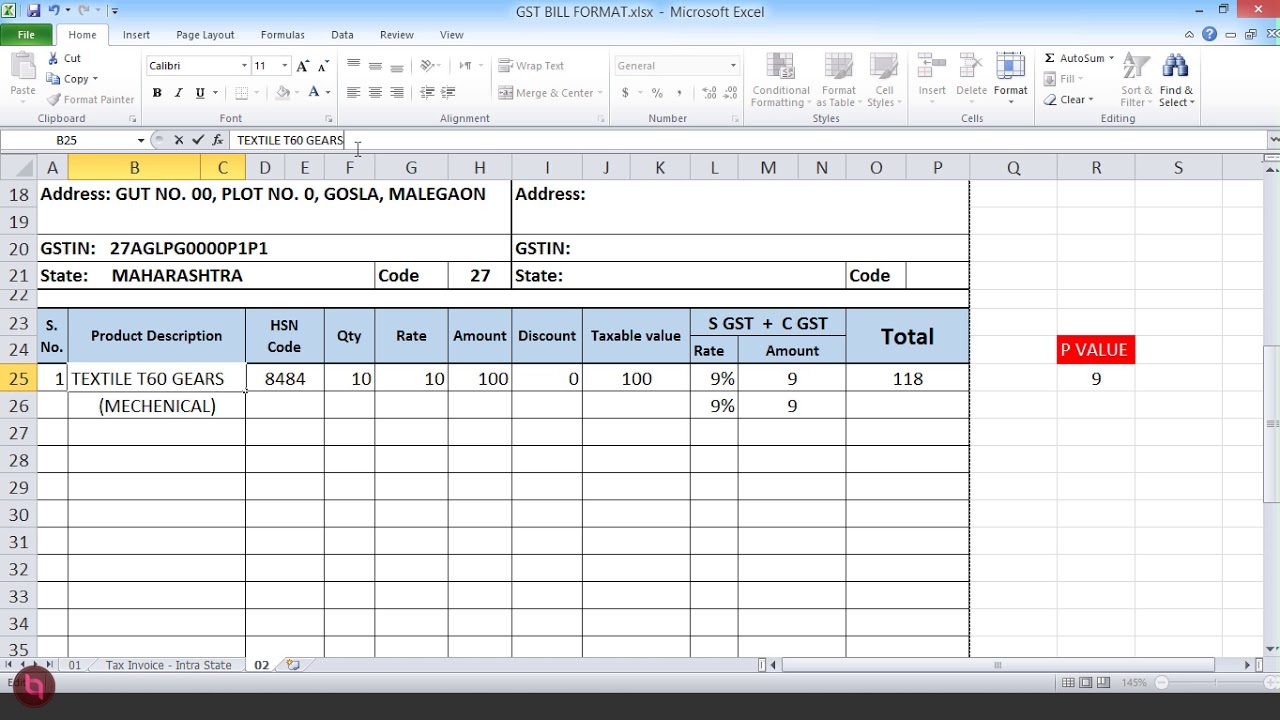

How to Create GST Bill Format in Excel with Formula ExcelDemy

How to Calculate GST in Excel? Maria December 13, 2023 GST News Print 🖨 PDF 📄 22 total views Calculate GST in Excel Goods and Services Tax (GST) stands as a pivotal aspect of modern taxation, streamlining the indirect taxation system across various goods and services.

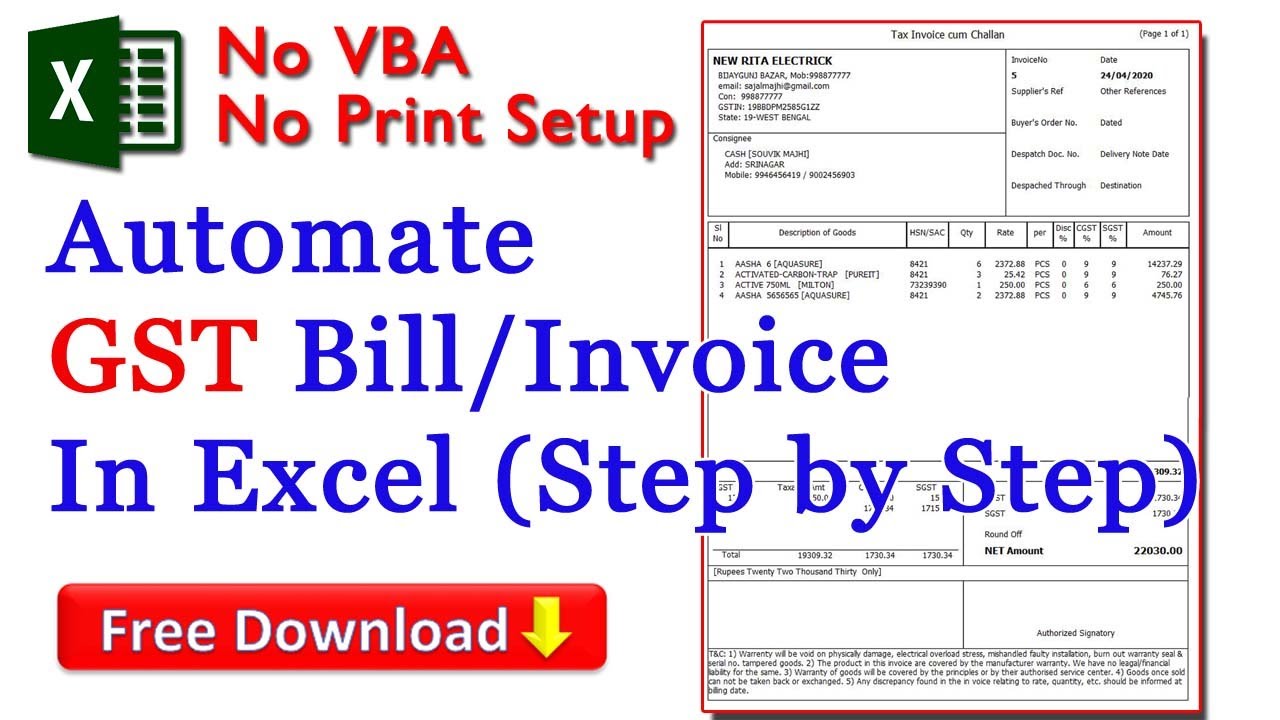

Automate GST Invoice In Excel using few easy formulas (Step by Step) YouTube

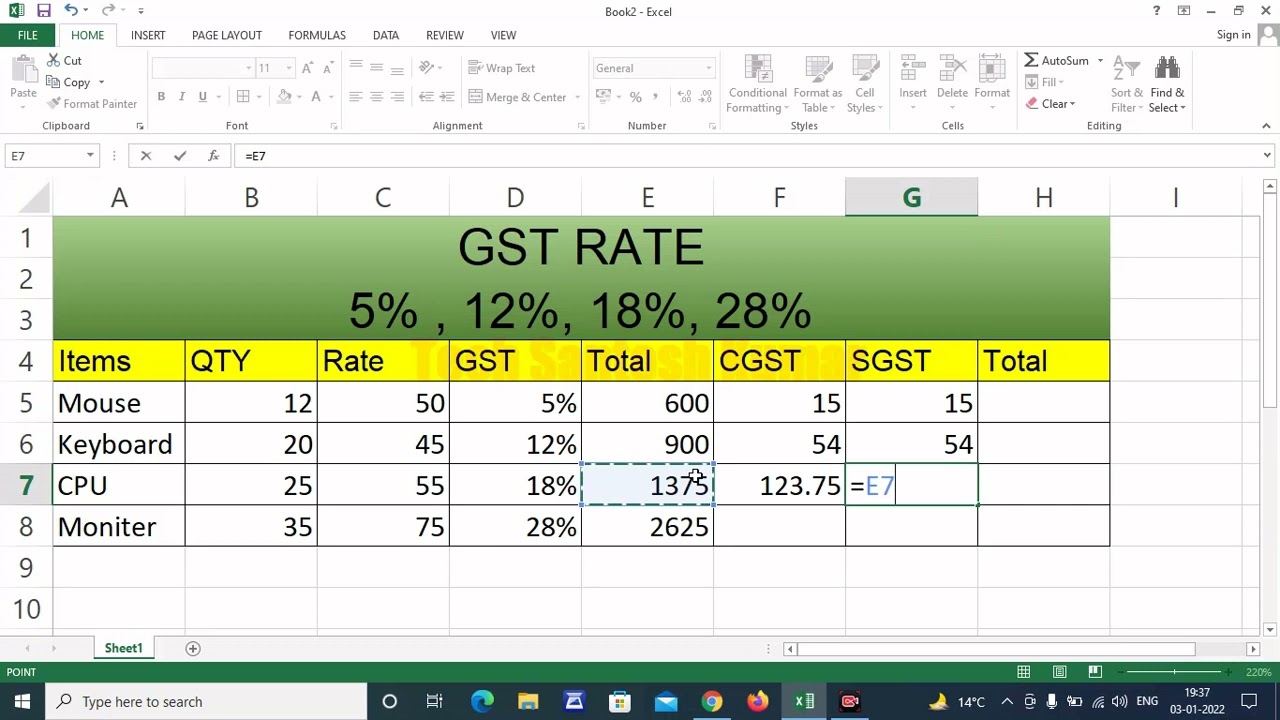

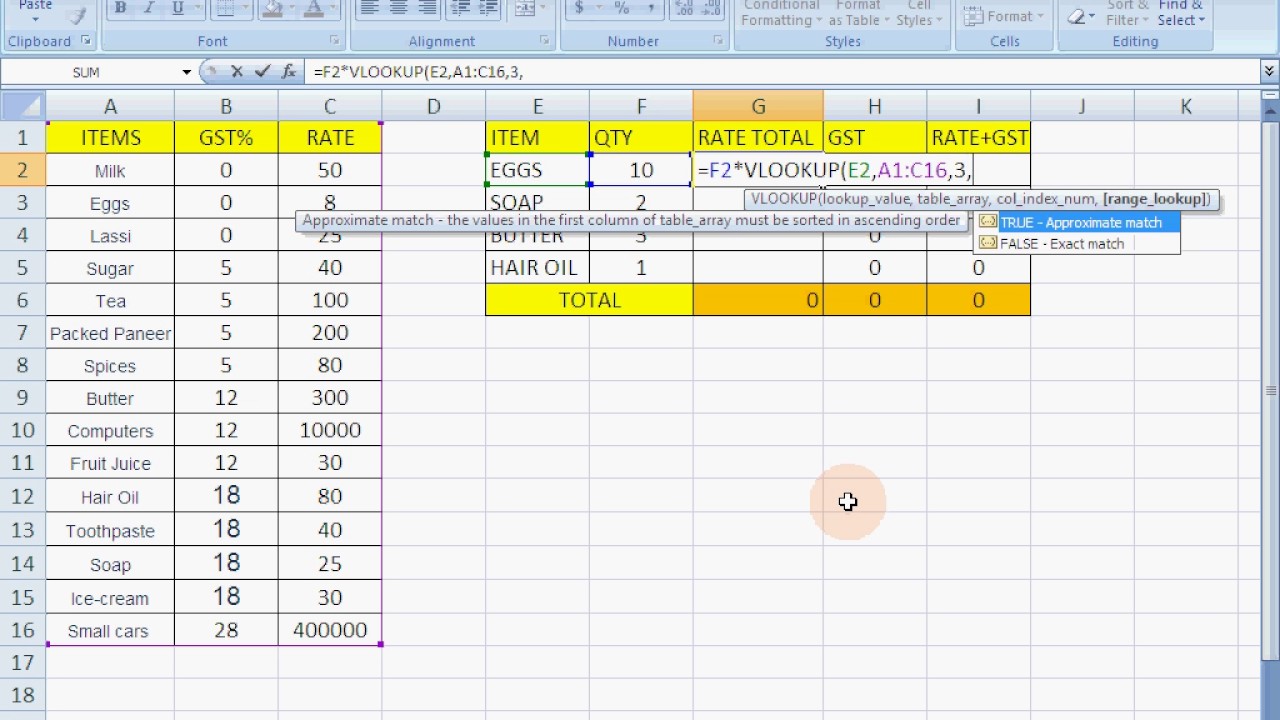

The GST goods can be categorized into the following 5 tax rates: 0%, 5%, 12%, 18%, and 28%. While there are certain goods including electricity, alcoholic drinks, petroleum products that are not taxed under GST. The individual state governments tax these goods separately based on the previous tax system. How to Calculate GST?

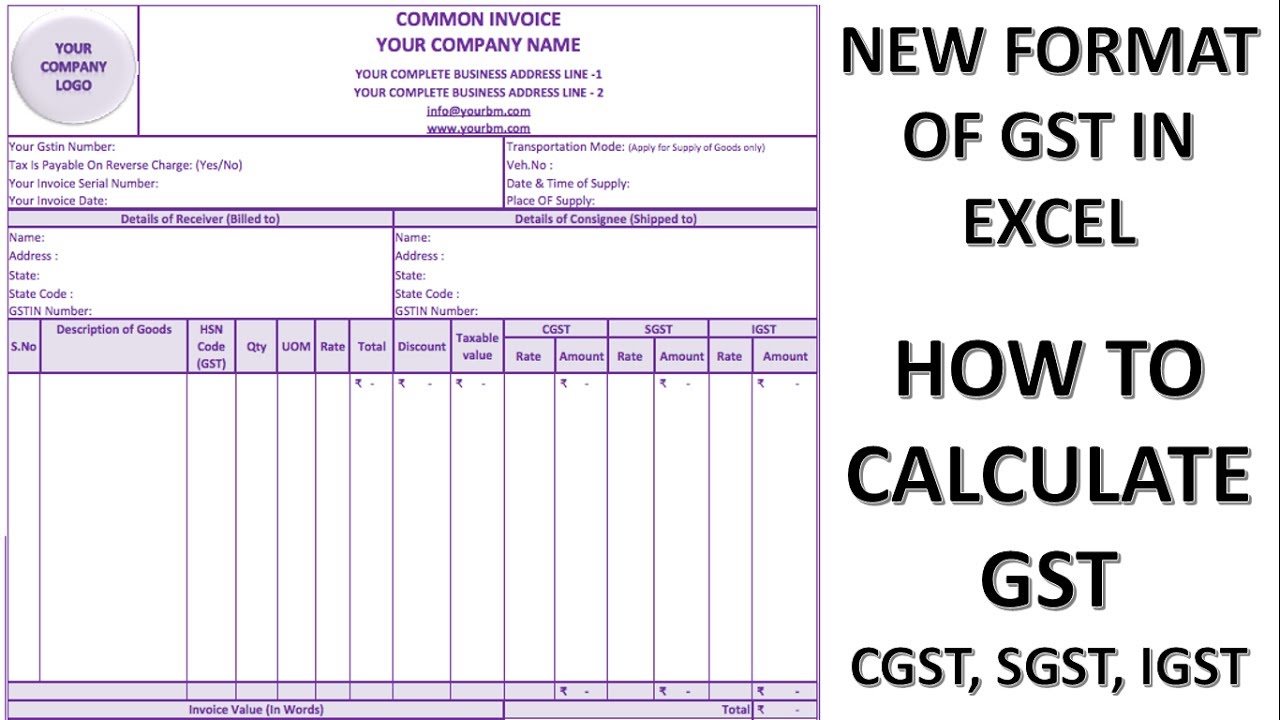

New Format Of GST In Excel. How GST Is Calculated YouTube

Step 1: Enter the GST rate The first step in calculating GST in Excel is to enter the GST rate. The GST rate is the percentage of the total value of the goods or services that is taxed. To enter the GST rate select the cell where you want to enter the rate type the GST rate as a percentage and press enter.

How To GST Work in Excel Full Work on GST Video GST Formula In MsExcel 18 GST Formula in

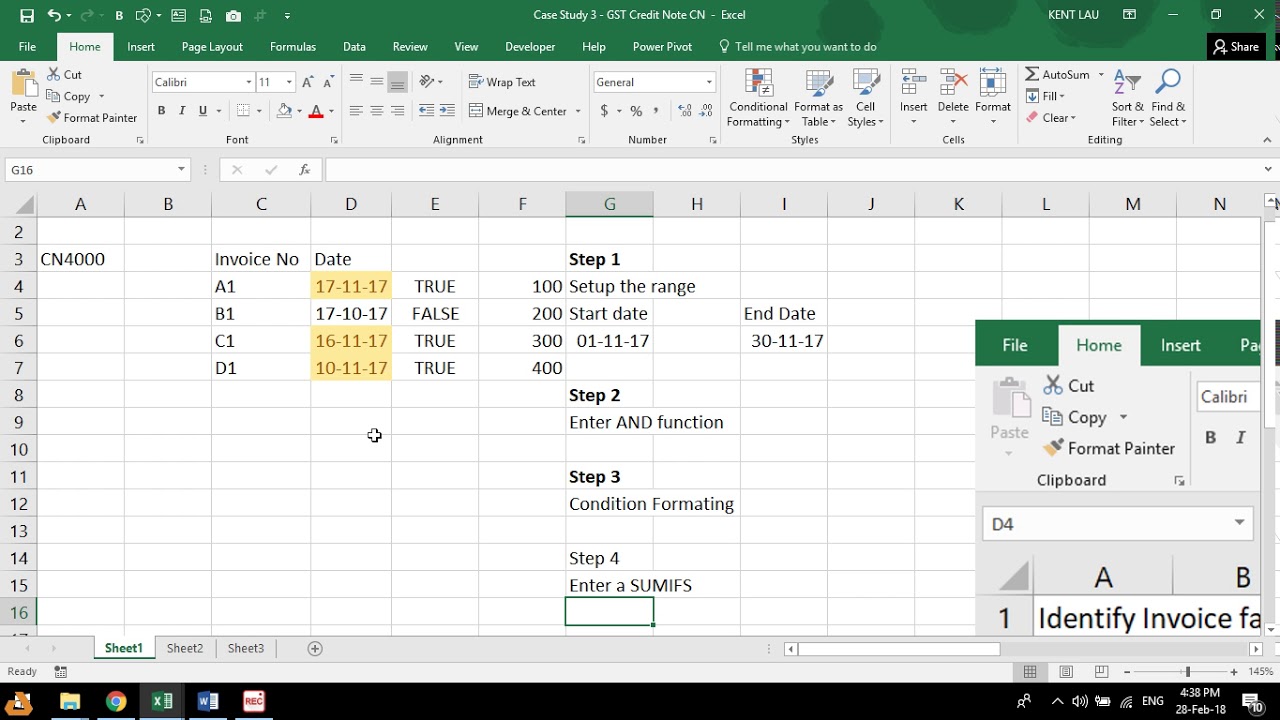

1. Creating Variable for GST Calculator Firstly, we need to assign variable names for calculating GST interest and put them in the column headings. We have assigned the following variable names for our calculator. Month Due Date Date of Feeling Status Days of Delay Net Tax Liability Interest GST Secondly, assign the Month and Due Date to file GST.

How to Calculate GST in Excel (With Easy Steps) ExcelDemy

GST Formula in Excel | How to Calculate GST - Australia & India Chester Tugwell 82.1K subscribers Subscribe Subscribed 61 Share 10K views 1 year ago In this video I demonstrate how to.

How to calculate gst in excel nsaveri

How to Calculate GST in Excel 1. Click on the cell where you want to calculate GST at 15% ( B2 ). 2. Go to the Formula bar. 3. Write the formula " =B1*15% ." Note: Alternatively, you can write the formula as " =B1*.15 ". Either way will work. 4. Press the Enter key on your keyboard. As easy as that, your GST value has been calculated.

How to Calculate GST in Microsoft Excel GST Calculator in Excel YouTube

The steps are: Step 1: Arranging Proper Dataset In this case, our goal is to calculate GST. But to do so, we need a dataset on which we will work. The step is. First, we have the Products in Column B and the Price Without GST in Column C. Next, we have to create three important columns.

How to Calculate GST in Excel Sheets?

Open a new sheet and select cell B5 then paste the values by pressing Ctrl + V together. Put the following formula in cell D5 and apply the Fill Handle tool to extract the invoice values from the GSTR-2A dataset based on invoice numbers- =VLOOKUP (B5,'GSTR-2A'!$E$4:$F$23,2,0)

automatic gst Calculation in excel YouTube

303 Share 84K views 7 years ago Learn Excel, Popular Formulas, Percentages & Shortcut Tricks This Excel tutorial shows different techniques to calculate and find GST amounts. This also.

GST FORMULA EXCEL IN HINDI YouTube

In this #exceltipsandtricks series we learn how to calculate GST in excel or multiplication in excel You can learn also some #excelfunctionsProduct Functionh.

GST Formula in MsExcel (Purchase GST in ms excel) YouTube

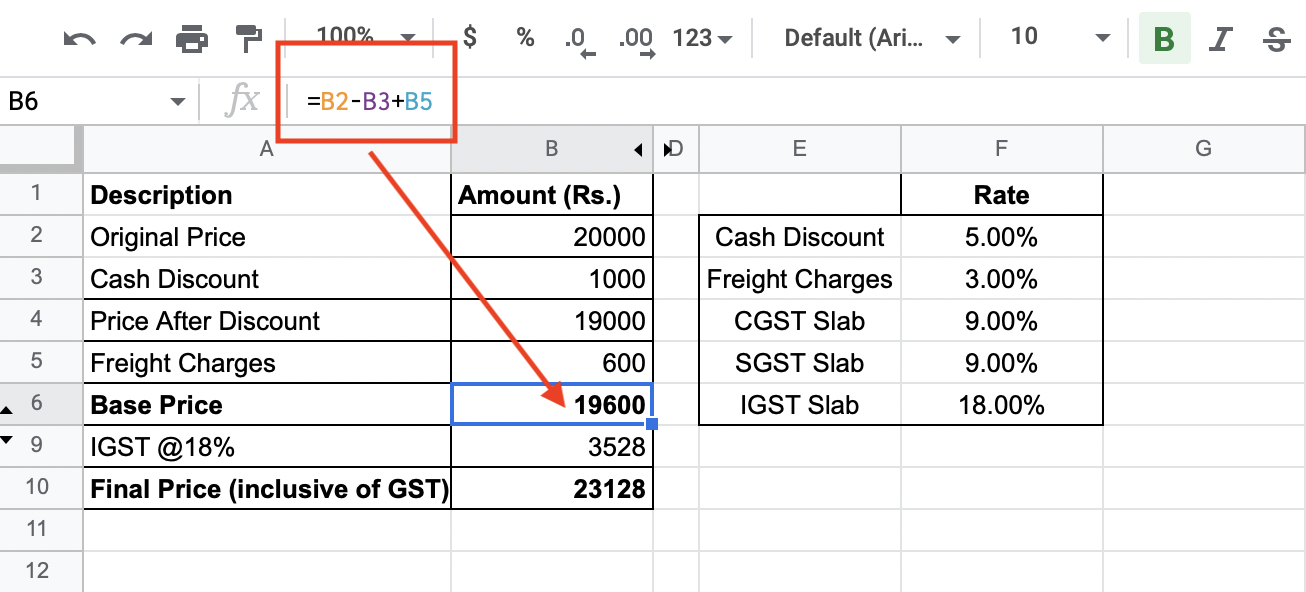

Step 1: Tabulate your cost price, discount, freight charges, and tax rate in the excel sheet. Step 2: Reduce the original price with the cash discount and add freight charges to it. In Excel, Base Price = Original Price - Discount + Freight Charges B6 = B2-B3+B5 B6 = Rs. 20,000-1,000+600 = Rs.19,600

Excel accounting with gst bubblecaqwe

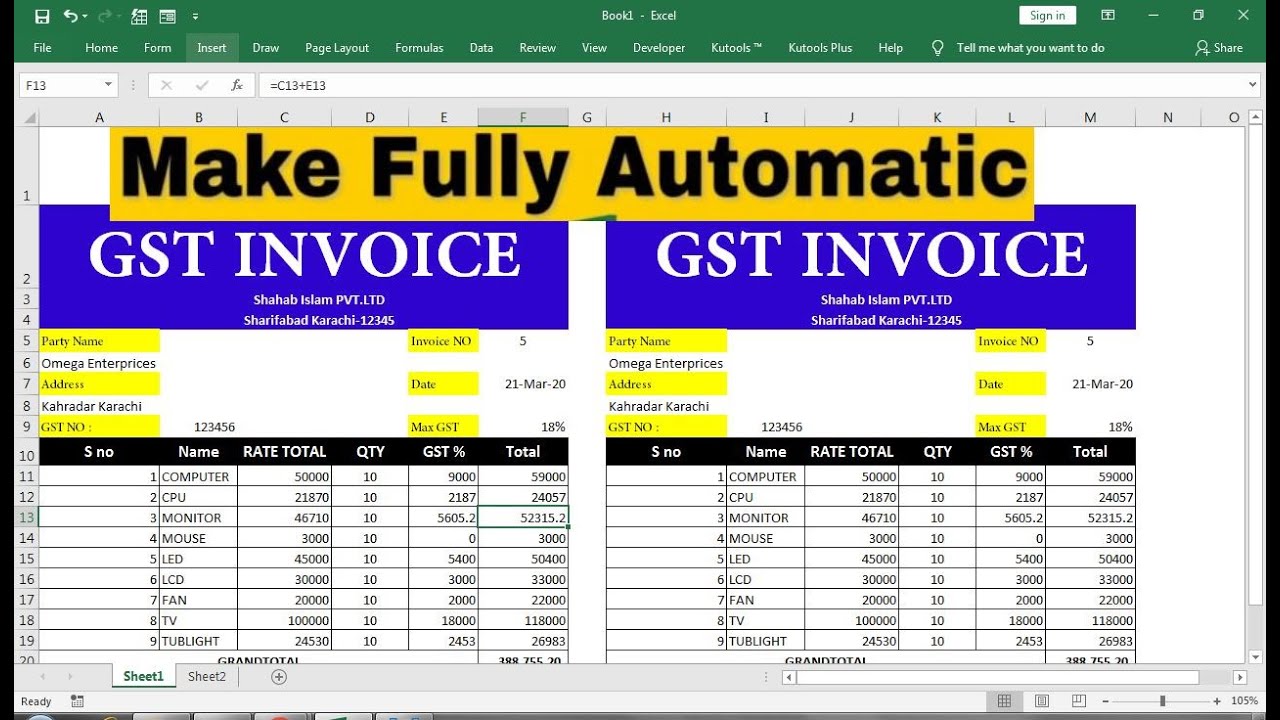

There are 4 steps to create a GST bill format in Excel with formula. We will learn these steps serially in this article. If we want, we can also reduce or increase the number of steps according to our needs. Here we will learn to create a demo GST bill format with formula in Excel. Step 1: Create Outline of GST Bill Format

DOWNLOAD GST INVOICE Automatic Calculation Ms Excel YouTube

GST = Original cost price x (Rate of GST/100) Example: 2-Interstate supply-computation of IGST in Excel Sheet The final price, inclusive of IGST, is cell C7=C5+C6 Example: 3-Intrastate supply-computation of CGST and SGST in Excel Sheet Final price is cell C8=C5+C6+C7 GST Calculator Offline Excel-Based Tool by GSTN Conclusion